Car Donation FAQs

Below are car donation FAQs to reference for clarification before or after donating. For additional vehicle and car donation FAQs, contact us at 1-800-729-4433.

What can I donate?

Always accepted, provided it has four tires and a clear title:

- Cars

- Light-duty trucks

- Vans

Case-by-case basis, depending on condition and location:

- Boats with road-worthy trailers

- Jet skis

- Motorcycles

- Mopeds/scooters

- Snowmobiles

- ATVs

- Garden/lawn tractors

- Go-karts

- Campers

- RVs (must be drivable to New London, Wisconsin)

- Dune buggies

- Heavy equipment

- Tractor trailers

- Fire trucks

- Semis

Rawhide is the only car donation program in Wisconsin that evaluates and inspects vehicles before they are re-sold.

What items are not accepted?

Sorry, we cannot accept:

- Personal household items

- Hazardous materials

- Electronics (e.g., TVs, computers, gaming equipment, etc.)

- Appliances

- Artwork

- Real estate

- Push mowers

- Paints

- Pianos or other musical instruments

- Pool tables

- Clothing (used)

- Shoes or other footwear (used)

- Solvents or other chemicals

- Exercise equipment

Why donate to Rawhide?

- We arrange vehicle pickup and transport at no cost to you.

- We accept all car and light-duty truck donations. If it has four rolling tires and a clear title, we want it.

- We consider boats, jet skis, motorcycles and campers depending on their condition and location (we only accept boats at our New London location).

- You have the option of dropping off your car or light-duty truck donation at a local drop-off center or you can wait for a free pickup.

- On average, vehicle donors receive a 48% higher tax deduction than other car donation charities.

- Over 77% of donation proceeds directly fund treatment programs and services for at-risk youth and families.

- When you donate to Rawhide, we handle your donation directly versus using a third-party reseller, so all the funds we receive from your donation stays in the state of Wisconsin to help build stronger families and better communities.

To donate, call us at 1-800-729-4433 or submit a form.

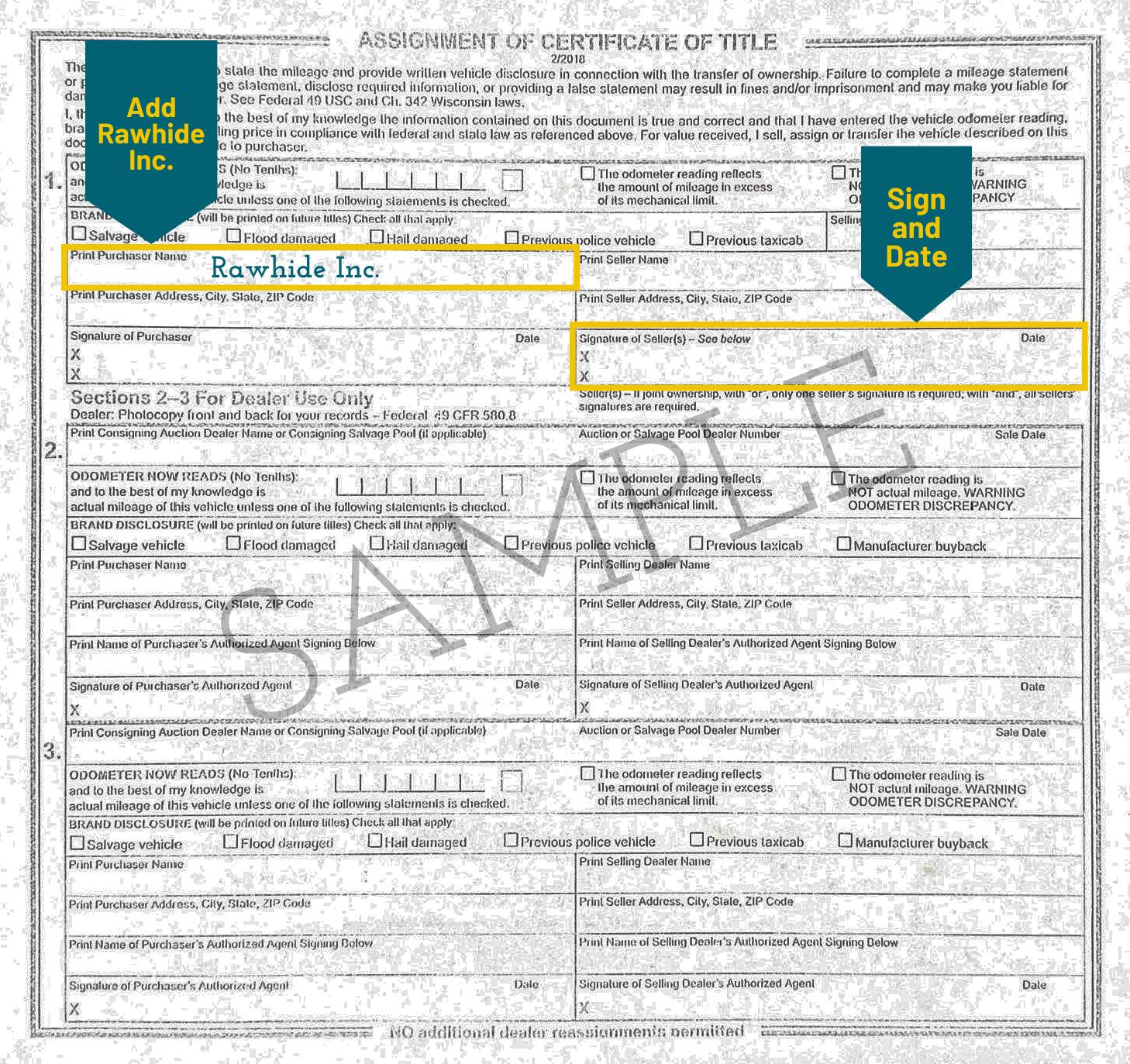

How do I prepare my Wisconsin title?

Car Donation Tax Laws

When you donate your car to Rawhide, we put our 40-plus years of car sales experience to work so you receive the maximum IRS tax deduction for your donation. We have satisfied thousands of donors, who have taken advantage of the tax savings multiple times per household.

Important Car and Vehicle Donation Tax Law Information*

Tax laws concerning donations have changed. Donors were once able to claim the fair market value (according to Kelley Blue Book) of the car or truck regardless of what it sold for.

Currently, the IRS allows a standard deduction of $500 for any donated car or truck. Once Rawhide receives the donation and title, our representatives will send you a tax receipt.

If your car or truck sells at auction for more than $500, then you may take the amount it sold for as your tax deduction. We will notify you via email or a letter in the mail of the amount and request your Social Security Number, which the IRS requires for the Tax Form 1098C (aka your tax deduction receipt).

Our production and sales teams work diligently to ensure you receive the maximum amount based on your vehicle’s age, condition and location to determine the best sales venue.

To learn more about what you are entitled to claim, please review the tax laws page on the IRS website.

*Donors must itemize their taxes to be able to claim the deduction.

We recommend consulting with a qualified tax professional to ensure compliance with IRS requirements as they apply to your specific donation and circumstances.

Qualified Appraisal of Charitable Contribution

Appraisals Required on Donations Valued Greater than $5,000

If you would like to donate a vehicle, boat, camper, airplane, industrial equipment and you believe it is valued at more than $5,000, the IRS currently requires you to obtain a qualified appraisal of charitable contribution from a private party. Multiple donations of similar items within a calendar year totaling over $5,000 will also require a qualified appraisal. To substantiate a tax deduction over $5,000, you will need to obtain a qualified appraisal within 60 days prior to donating your gift.

Rawhide does not provide qualified appraisal services due to the conflict of interest. Donors must obtain a qualified appraisal from a third party. An appraisal must give all the facts on which to base an intelligent judgment of the value of the property.

How much will I receive as a tax deduction for my car donation?*

The IRS allows you to claim a tax deduction of:

a) The value of your vehicle up to $500. It is up to the donor to determine the fair market value.

b) The amount we sell your vehicle for if it is more than $500.

*The deduction is of the sale value only if the donor itemizes their deductions.

Rawhide Inc., is a classified 501(c)(3) charity organization. You can check with your tax adviser or accountant to determine how a tax benefit would affect your tax situation.

Please see Qualified Appraisal of Charitable Contribution section above for more information.

Do I need to submit a Form 1098C?

The IRS requires you to provide specific information regarding your car donation, boat donation, or airplane donation. Although you are not required to complete a 1098C, it does provide the format of the information that is required. If you plan on claiming more than $500, we will provide you a copy of the 1098C.

Will I receive a receipt telling me how much you sold my car for?

We will send an initial receipt when you complete your paperwork. If you plan to claim over $500, we will need your social security number before sending an additional receipt with the sale amount Rawhide received.

What date will be on my receipt?

The date for your tax deductible receipt will be the date you signed over your title to Rawhide or the date you submitted your donation to Rawhide.

Do you give estimates on the sales amount for donations?

Rawhide can provide a range of what similar vehicles have sold for at auction as a comparison, although, this is not a guarantee of the amount we will be able to sell your donation for, based on year, make, model, condition, mileage, and current market conditions.

Do youth fix the car donations?

All donations are evaluated and inspected, although not all donations are repaired. The students at Rawhide have an opportunity to be involved in a work experience including helping evaluate, detail, and complete minor repairs on select donations.

Where do you accept car donations from?

We accept cars nationwide. Please call our donation experts at 1-800-729-4433 to determine if we are able to pick up your vehicle.

What must I do to my car in preparation of donating?

Please clean out personal items from the vehicle and remove the license plates before we pick up the vehicle.

My car isn't running, will you still accept my donation?

Yes, we accept both running and non-running vehicles. If it rolls, we want it.

How long will it take to sell my vehicle?

Typically, we will process and sell your vehicle within approximately three months. Although, due to market conditions, this process may take longer.

Can you pick the car up at my home?

Yes, we have the availability to pick up vehicle donations from your home or an individual location. Please call with the details of your situation.

How quickly can you pick up my car?

As soon as we receive all of the information, we strive to have the vehicle picked up within 2-3 business days.

Do I need the title to donate my car?

Rawhide can only accept a vehicle with a title from the last registered owner of the vehicle. If you are not the last registered owner and would like to donate the vehicle, you will need to register as the new owner with the Department of Motor Vehicles. If you have lost your title, you may obtain a duplicate from the Department of Motor Vehicles.

For more information, read our comprehensive guide on changing the owner on a title or call one of our donation experts at 1-800-729-4433.

Where is the nearest location where I can drop off my car?

Rawhide offers around 175 convenient locations throughout Wisconsin to drop off your vehicle. You may obtain the closest location by completing the car donation form or calling 1-800-729-4433.

Does Rawhide sell cars?

Donated vehicles are sold to licensed auto dealers at wholesale dealer-only auctions. Select collector vehicles are sold on our eBay store and available to the general public.

The tires on my vehicle are new, can I keep them?

Your donated vehicle must have tires and wheels that roll to ensure we can safely load and transport the vehicle. If you have new tires on the vehicle that you wish to keep, place an alternate set of tires on the vehicle before pickup.